- The Ultimate Cheap Car Insurance Guide

- Understand Your Insurance Needs When Shopping For Cheap Car Insurance

- Liability only coverage VS Full coverage: In a Nutshell

- Best Cheap Car Insurance Quotes – Compare, Compare, Compare

- Who typically has the cheapest car insurance?

- Cheap Car Insurance – Boost Your Deductible, Trim Your Premium

- Comprehensive Vs. Collision: In a Nutshell

- Embrace the Power of Discounts For Cheap Car Insurance

- Verdict – Finding Cheap Car Insurance Is Not Hard

- Frequently Asked Questions About Cheap Car Insurance

- INSURANCE SERVICES WE OFFER

Understand Your Insurance Needs When Shopping For Cheap Car Insurance

Before embarking on your quest for cheap auto insurance rates, it’s essential to assess your specific coverage needs. Factors such as your vehicle’s value, your driving habits, and the legal requirements in your area will influence the type and amount of coverage you require. By understanding your needs, you can avoid paying for unnecessary coverage and focus on finding the best cheap car insurance for what matters most to you.

Liability only coverage VS Full coverage: In a Nutshell

Liability-only Insurance is the basic type of auto insurance that covers damage or injuries you cause to others in an accident for which you are deemed legally responsible.

Full coverage, in a nutshell, refers to a type of insurance policy that provides comprehensive and collision coverage. This protects you from a wide range of risks and potential damages.

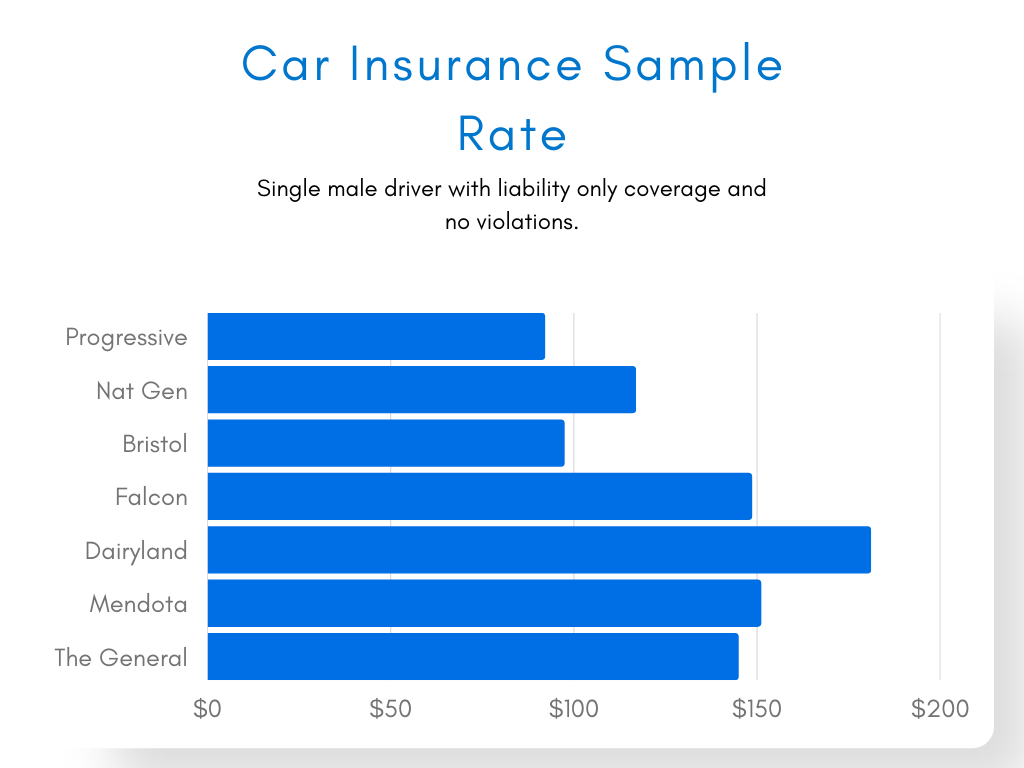

Best Cheap Car Insurance Quotes – Compare, Compare, Compare

One of the most effective ways to find cheap auto insurance rates is by comparing quotes from different insurance providers. Thanks to the internet, obtaining multiple quotes is easier than ever. Take advantage of online comparison tools that allow you to enter your information once and receive quotes from various insurers. Don’t settle for the first quote you receive; take the time to compare coverage options and rates to ensure you’re getting the best deal.

Imagine shopping for a new car and buying the first one you see without exploring other options. It’s highly unlikely you’d end up with the best deal. The same principle applies to auto insurance. By comparing quotes, you can discover hidden gems, such as discounts and special offers that could significantly reduce your premiums. Plus, with a little extra research, you can find insurance companies that specialize in offering lower rates to specific demographics or driving profiles.

Who typically has the cheapest car insurance?

Insurers consider various factors when determining premiums, including driving history, age, location, and vehicle type. Generally, drivers with a clean record and minimal claims history are rewarded with lower premiums. Young drivers under 25 often face higher rates due to their perceived higher risk, but discounts like good student incentives or completion of defensive driving courses can help mitigate costs. Furthermore, where one lives can significantly impact insurance rates, with rural areas typically offering cheaper premiums compared to urban centers with higher rates of accidents and theft. Moreover, the type of vehicle being insured plays a pivotal role; older, less expensive cars typically incur lower premiums than newer, higher-value vehicles. By understanding these factors and exploring available discounts, individuals can navigate towards securing the cheapest car insurance that aligns with their needs and budget.

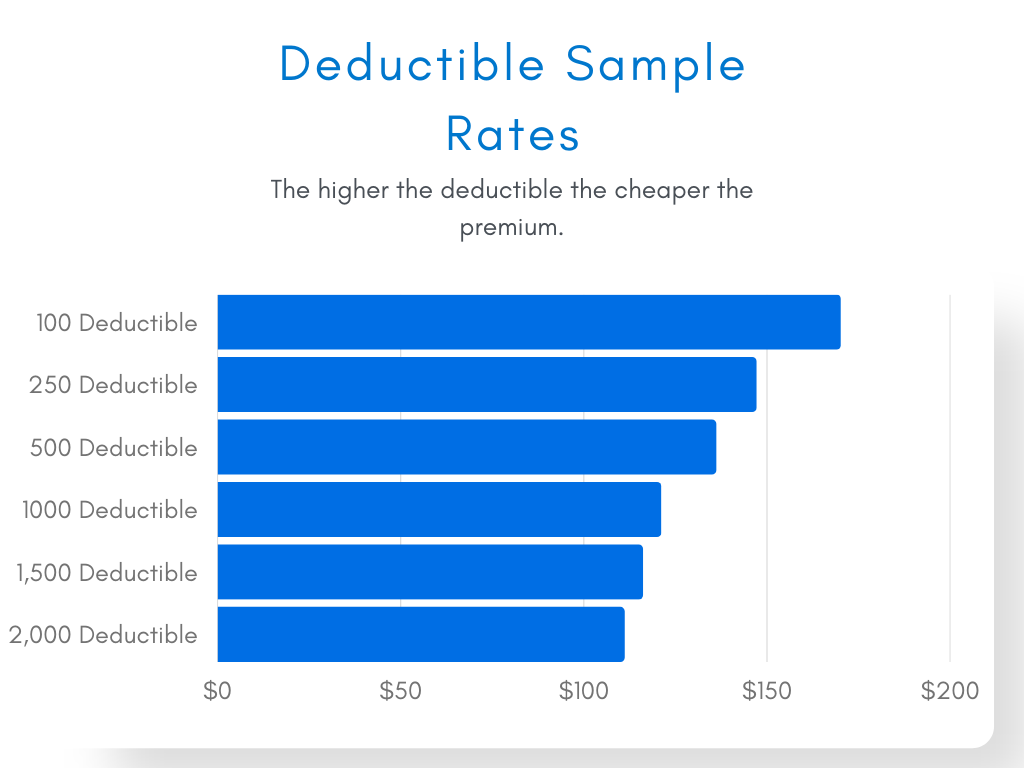

Cheap Car Insurance – Boost Your Deductible, Trim Your Premium

Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in after an accident. Opting for a higher deductible can help lower your premium significantly. However, it’s important to ensure you can comfortably afford the deductible should you need to make a claim. Assess your financial situation and determine the right balance between your deductible and premium. By increasing your deductible, you take on more risk but potentially enjoy lower monthly premiums.

Think of your deductible as your contribution to the overall cost of a potential accident. By raising your deductible, you show the insurance company that you’re willing to assume more responsibility for minor damages, which reduces their risk. In return, they reward you with lower premiums. Remember, accidents happen, but if you’re a safe driver and have built up an emergency fund, increasing your deductible can be a smart way to save on your monthly insurance costs and find cheap car insurance

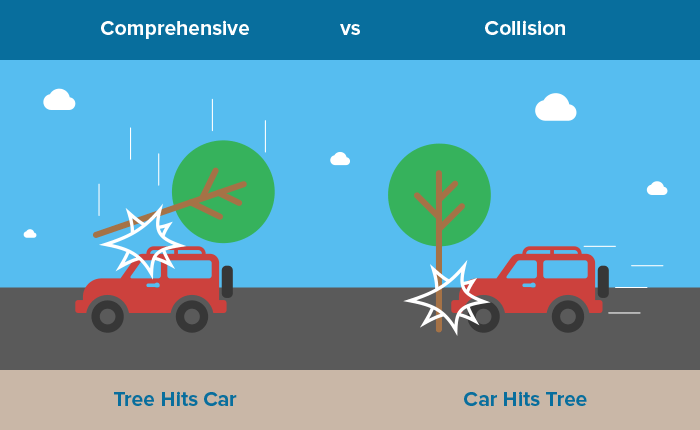

Comprehensive Vs. Collision: In a Nutshell

If you recently financed a vehicle, your lienholder may have required you to have full coverage insurance.

While many people assume full coverage is an all-encompassing auto insurance policy with all the coverages, that assumption is incorrect.

Full coverage insurance simply means you are adding comprehensive and collision coverage, the two kinds of coverage that cover Physical Damage to your own vehicle. You must also carry whatever your state requires.

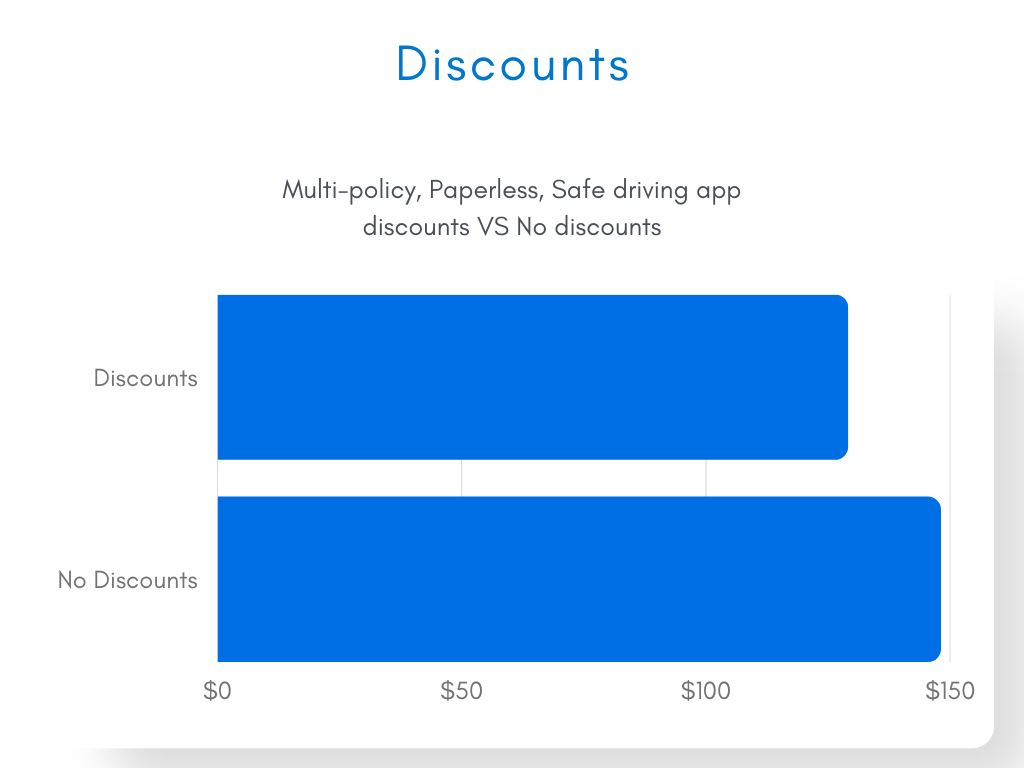

Embrace the Power of Discounts For Cheap Car Insurance

Insurance companies offer a wide range of discounts that can help you lower your premiums. Make sure you explore all the available discounts and take advantage of any that you qualify for. Some common discounts include safe driver discounts, multi-policy discounts, good student discounts, low-mileage discounts, and discounts for specific safety features in your vehicle. Every little discount adds up and can make a significant difference in your overall premium.

Who doesn’t love a good discount? Insurance companies are well aware of this fact, and they’re more than happy to reward you for various factors that demonstrate your responsible behavior as a driver. From maintaining a clean driving record to bundling your auto insurance with other policies, be sure to inquire about any potential discounts. These discounts can help you save a considerable amount of money while still enjoying the protection you need.

Verdict – Finding Cheap Car Insurance Is Not Hard

By understanding your coverage needs, you can ensure that you’re getting the right level of protection while finding cheap car insurance. Take the time to assess factors such as the value of your vehicle and the legal requirements in your area. Additionally, comparing quotes from different insurance providers is crucial in finding the most affordable rates. Utilize online comparison tools to easily receive multiple quotes and compare coverage options. Another strategy is adjusting your deductible, which can have a significant impact on your premiums.

Consider increasing your deductible if you have the financial means to cover a higher out-of-pocket expense in the event of a claim. Lastly, be sure to explore and take advantage of available discounts. Insurance companies offer various discounts for safe driving, bundling policies, having certain safety features in your vehicle, and more. These discounts can greatly reduce your premium and make your auto insurance more affordable. By implementing these strategies, you can unlock affordable auto insurance rates while still ensuring you have the coverage you need.

Frequently Asked Questions About Cheap Car Insurance

Q1: What is cheap car insurance?

A1: Cheap car insurance refers to auto insurance policies that provide coverage at a lower cost. It typically offers the legally required minimum coverage but may have limited coverage options and higher deductibles to keep premiums affordable.

Q2: How can I find cheap car insurance rates?

A2: To find cheap car insurance rates, you can compare quotes from multiple insurance providers, maintain a good driving record, consider higher deductibles, bundle policies, and inquire about available discounts. Working with an insurance agent can also help you find budget-friendly options.

Q3: What are some factors that affect the cost of car insurance?

A3: Several factors can impact the cost of car insurance, including your driving history, age, type of vehicle, coverage level, location, and more. Insurance companies consider these factors when calculating your premium.

INSURANCE SERVICES WE OFFER

Homeowners Insurance

Homeowners, renters, and mobile home owners: make sure you have the protection you need.

| Additional links for Cheap Car Insurance |

|---|

| Use An Insurance Broker |

| Lower Your Auto Insurance Rates |

| Cheap Car Insurance Companies |

| Cheap Car Insurance Quotes With SR22 |

Last Updated on by Alexis Karapiperis